Stay ahead of the curve

Instant clarity on complex crypto transactions.

Structured, auditable, and regulator-ready.

Get Cense Certified

Take our crypto courses to upgrade your knowledge and skills

Why it makes Cense?

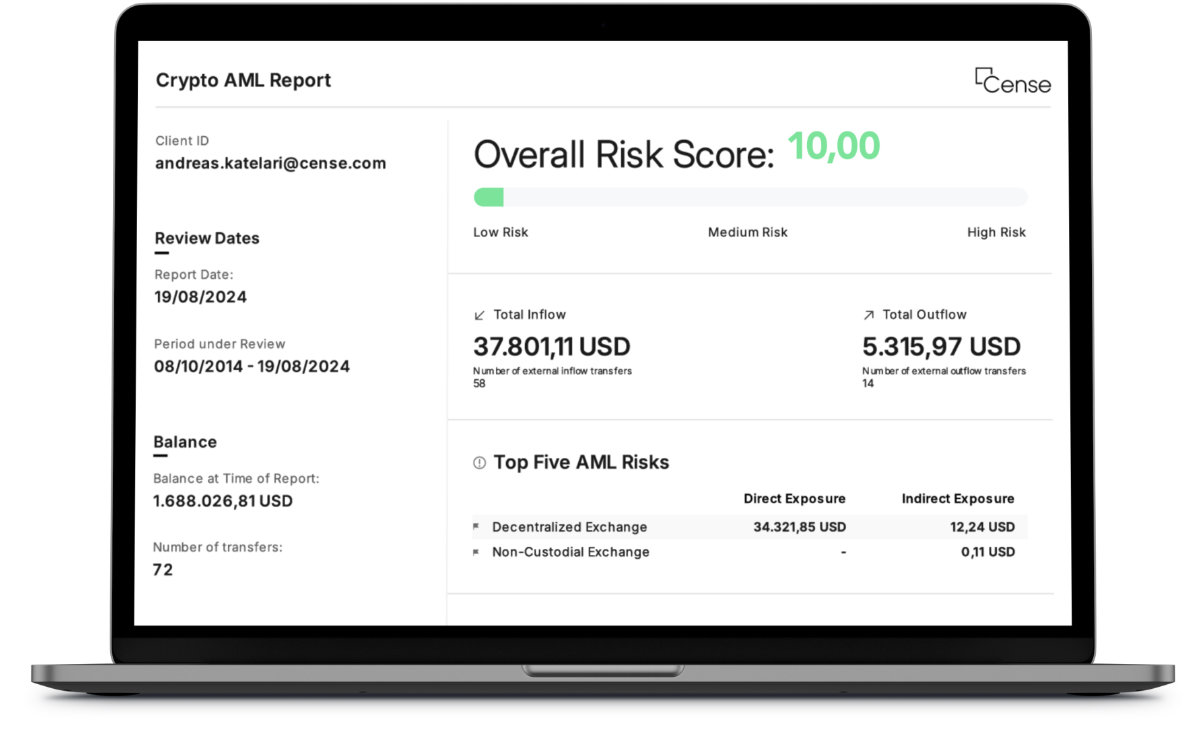

Clear, auditable compliance reporting

Easy to read PDFs that tell the complete story under a minute. Source of Funds, automatic trades, obscure assets, hidden wealth and much more.

Risk-based reviews & monitoring

Data tells the truth. Based on your risk appetite, we provide a risk score for a client. Rerunning a report is a click on a button.

Faster and more efficient processes

Turn hours and days into minutes. Cense automates the manual work, across different exchanges, blockchains and assets and automatic trading.

Regulatory alignment and controlled risks

Built on your Financial Economic Crime Risk Framework, Cense ensures you meet every compliance requirement with confidence, providing instant clarity on crypto-related risks.

Plug & Play

Cense integrates seamlessly with your existing tools, so you can start immediately. SOC 2 audited and GDPR compliant, we ensure your data remains secure.

Automating your process

-

Data Collection

With our advanced middleware system we collect all the relevant data. Whether it’s from Coinbase, or Kraken or a DeFi wallet like a Bitcoin wallet.

-

Data Harmonization

After collecting, we first harmonize the data structure and augmenting it with the right pricing data and risk levels.

-

Data Analysis

We calculate everything for you, providing you with a clear understanding of Source of Funds, Source of Wealth and all other relevant AML information points.

-

Reporting

We wrap everything up for you in an easy to understand PDF. With easy to understand reports, we guide you in the crypto compliance journey. Not only for AML compliance but also Tax Compliance.

-

Financial Economic Crime

Want to deep dive further? With our underlying excel reports, you will have all the data needed in a structured way to immediately start your investigation, saving up hours of work.

-

SAR

Need to report unusual activities? Our exports are very suitable as attachments on your SAR providing all the right data for authorities to continue their investigation.

Clear, auditable

reporting that works

in the real world.

Cense gives you the insights and documentation

you need to make informed compliance decisions

quickly and accurately.

Our main features.

Mitigate your risks

Today, consumers hold significant digital assets. Because they have bought and sold those assets through your bank accounts, your existing risks need to be managed carefully.

Comprehensive user profiling

It’s crucial to understand your clients’ risk profiles, so with Cense you get a 360-degree view of your clients – including their Blockchain activities across multiple platforms.

No more manual data consolidation and assessment

Cense sends you harmonised data files per portfolio with on-chain and off-chain data combined, ready to use in your own dashboarding and investigations.

No need for advanced crypto expertise in your compliance team

Cense has fully automated systems you can trust, combined with online certifications that will boost the confidence of your compliance officers.

Offload your workload to your customers

To get started, just send a simple link to your customer. Once they’re registered with us, you’ll receive a due diligence report automatically. If you prefer, you can support your customers directly and onboard them easily through our system.

SOC2 and GDPR compliant – and easy to integrate

Users trust Cense with their data – and you can trust us to calculate correctly. We augment our data with your existing systems including Chainalysis, TRM Labs and Elliptic.

Ready for a deep dive?

Access our whitepaper to uncover risks and opportunities in Virtual Assets.

Your questions,

answered.

Got a question? Ask away. You’ll find answers to our most commonly asked questions right here, whether you’re a digital asset holder, or are in compliance or asset management at a bank. If you can’t find what you’re looking for, feel free to talk to one of our experts.